This is a short guide on how to create a Sell Limit Order in Degiro. In case you didn’t already know, a Sell Limit Order allows you to tell Degiro the minimum price that you are willing to sell a stock at. By setting up a Sell Limit Order, you are instructing Degiro to automatically sell your stocks / securities as soon as they reach a specified price.

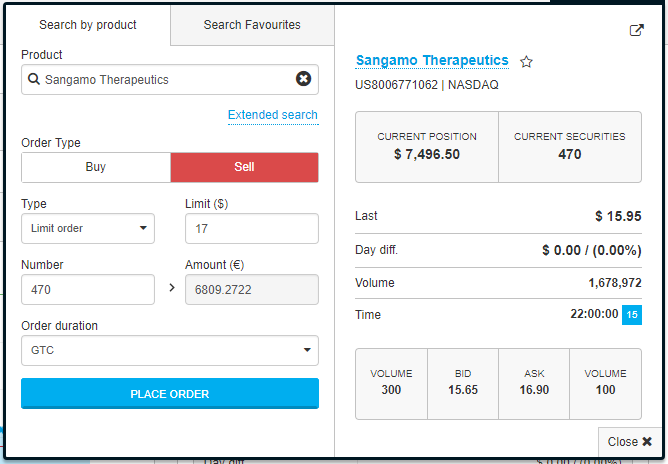

In this example, I will be setting up a Sell Limit Order for Sangamo Therapeutics (SGMO) using Degiro’s website. Here is a screenshot of the popup that appears when you press the Sell button:

If you look at the screenshot above, you will notice the following:

- My Order Type has been set to Sell, as opposed to Buy.

- In the Type dropdown menu, I have selected Limit Order.

- In the Limit ($) field, I have entered $17 dollars.

- In the Number field, I have entered 470. The Number field is where you enter the amount of shares that you want to sell.

- I have set the Order Duration to GTC, which stands for “Good Until Cancelled”.

- The last price for SGMO was $15.95, which is $1.05 less than the $17 figure that we entered into the Limit ($) field.

To summarize the above, I have basically told Degiro that I want to want to sell 470 shares of SGMO as soon as the stock price reaches $17 or above. If the stock price for Sangamo Therapeutics reaches $17 dollars, then Degiro will automatically attempt to sell those shares at that price. If the stock price “gaps up” to $17.20 dollars, then those 470 shares could sell for $17.20 per share. All in all, I am telling Degiro that $17 is the minimum price that I am willing to sell those shares at. Anything less will not do.

A Sell Limit Order is extremely handy, as it means that Degiro will automatically sell my shares as soon as my price target has been met. i.e. I don’t need to watch the stock price all day in order to make a profit. My shares could sell while I’m out getting a coffee or driving home from work in my car.