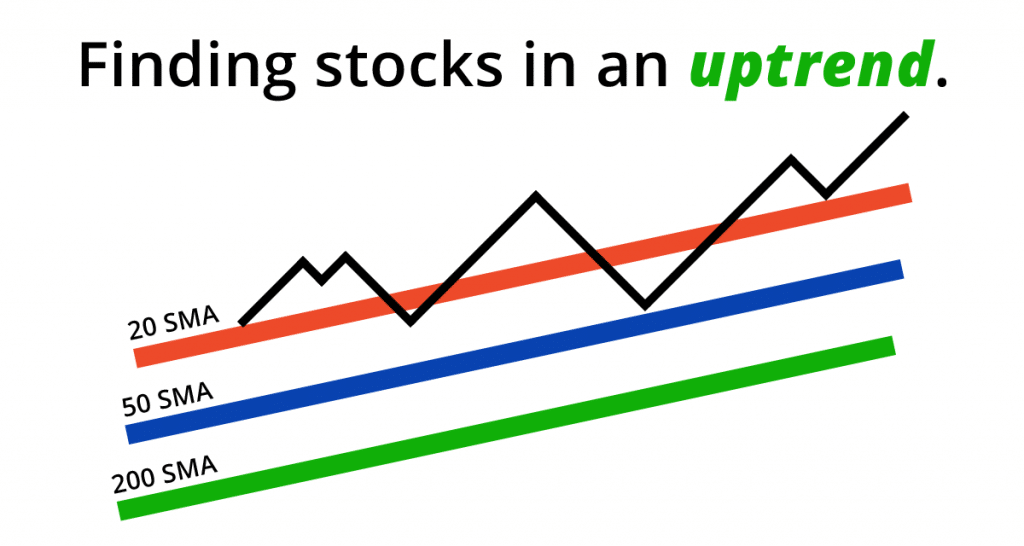

This is a tutorial on how to use FINVIZ to find stocks that are in an uptrend.

As you probably already know, FINVIZ is a free online stock screener. By using a stock screener, we can weed out stocks that meet certain criteria.

In this case, we want to find stocks that are in an uptrend. In other words, we want a list of companies whose share prices have recently been going up.

To do this, we will be using Simple Moving Averages.

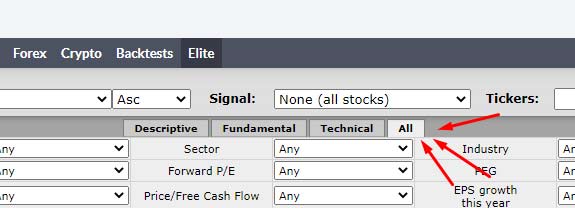

1. Go to the FINVIZ screener and choose the “All” tab.

Firstly, you will need to go into the FINVIZ screener and choose the “All” tab.

Click on the “All” tab.

By clicking on the “All” tab, we are merging the Descriptive, Fundamental and Technical sections into one page. In my opinion, this makes it easier to see everything.

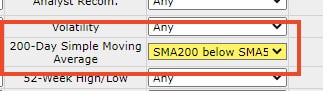

2. Change the 20-Day Simple Moving Average.

After that, you will need to change the 20-Day Simple Moving Average option to Price above SMA20.

This option will be located on the left, underneath Performance.

3. Set the 50-Day SMA to “below SMA20”.

Then, in the second column, set the 50-Day Simple Moving Average indicator to SMA50 below SMA20.

By doing this we are basically telling FINVIZ that we want to see stocks that have recently been trending higher.

4. Change the 200-Day SMA option to “below SMA50”.

Finally, you will need to change the 200-Day Simple Moving Average option to SMA200 below SMA50.

At this stage, you will be shown a list of stocks that are currently in a strong uptrend.

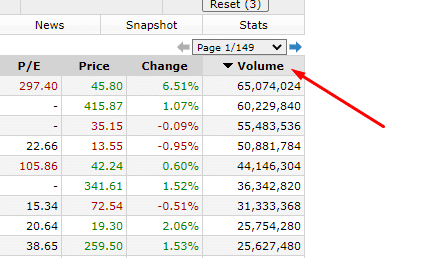

Furthermore, you will also be able to order this list by Volume.

High volume is important in this case as it basically confirms that the trend is real. It also shows that traders and investors have an “interest” in the stock.

When the volume on a stock is relatively low, the share price can be susceptible to manipulation and “promotion”. It can also be difficult to sell your shares once your target price has been reached.

To make a long story short, you should focus your attention on stocks that have a high volume.

These filters can return A LOT of stocks that are in an uptrend.

It is likely that these filters will return a lot of stocks that are in an uptrend. Thankfully, FINVIZ has other options that you can use to reduce this list even further.

For example, you could set the Exchange option to NASDAQ or NYSE. You could also play around with the P/E setting to weed out the stocks that are “overpriced”. For example, if the price-earnings ratio is high, then it could indicate that the share price is too high at the moment. That or investors are willing to pay higher prices because of their future expectations for the company.

These filters do not guarantee that the stock will continue to trend upward.

Although these indicators can help you to spot stocks that are in an uptrend, it is important to note that past performance does not guarantee future results.

In other words, the trend could end next week or five years from now.

As always, do your due diligence on a company before buying shares in it.

To make a long story short, you should believe in the future of a company before you invest your money in it.

Buying stocks on technical analysis indicators alone can be a dangerous game. Especially if it is a crappy penny stock. If the trend suddenly stops, FUD will set in and you will most likely sell at a loss.