If you have ever traded stocks on Revolut, then it is likely that you have come across the term “Unsettled sale proceeds” at some point in time.

In short, “Unsettled sale proceeds” is money that you are due to receive after selling a stock. However, you will be unable to withdraw this money until the sale is 100% complete.

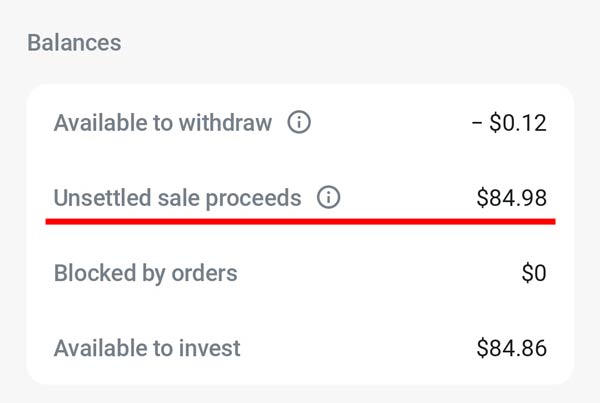

If you go into the “Available to invest” section on Revolut, you will be shown the following screen.

In the screenshot above, you can see that I have $84.98 in unsettled sale proceeds. This is money that I cannot withdraw until the sale of my stocks is complete. Once the sale is complete, this money will be added to my “Available to withdraw” balance.

Although you can instantly sell shares at the click of a button, the process behind the sale actually takes a couple of business days.

This is called the “Settlement Period”. For example, in the USA, the “Settlement Period” lasts for two business days after the day of the sale. This is a rule that is set down by the SEC. It is not something that Revolut came up with themselves.

The Revolut app offers up the following explanation.

In other words, this money is pending until the person who purchased your shares becomes the new official owner of them.

How long does it take for unsettled sale proceeds to become available for withdrawal on Revolut?

Typically speaking, it will take between 3-4 business days before your unsettled sale proceeds become available to withdraw on Revolut. This includes the day that you sold your shares.

The Settlement Period on US stocks is two business days starting after the day of the sale. For example, if you sold your stocks on Monday, then the Settlement Period won’t end until after Wednesday. This is also known as “T+2”.

For example.

- T: Monday: The day that the trade occurred on. In other words, the day you sold your stocks.

- 1: Tuesday: The first day after the trade.

- 2: Wednesday: The second day after the trade.

However, this doesn’t necessarily mean that you will be able to withdraw the cash on Wednesday. Judging from my own personal experience, it might be Thursday or Friday before Revolut actually makes your cash available to withdraw.

This is one of the reasons why you should never invest money that you might need in the immediate future. Investing in the stock market is a long-term process. It is likely that you will lose money if you try to use it as a short-term savings account.

As a result, you should only ever invest money that you won’t need to touch for the foreseeable future.