This is a short tutorial on how to find volatile stocks using the Finviz screener.

Volatile stocks are attractive to day traders. This is because the large swings in price provide traders with the opportunity to make a quick profit. Or a quick loss, if they’re not careful enough.

The goal here is to find high volume stocks that are volatile. Volume is extremely important in this case, as it means that there are plenty of buyers and sellers. If the volume on a ticker is too low, you might find it difficult to exit the trade at your target price.

There is also a possibility that the volatility isn’t genuine. For example, a relatively small amount of trades might be causing wild swings in the price.

“Buckle up!”

If you don’t want to go through the effort of following a step-by-step guide, you can click on the following link. This link is basically a Finviz “shortcut” that automatically fills out all of the relevant options for you.

Finding volatile stocks with the free Finviz screener.

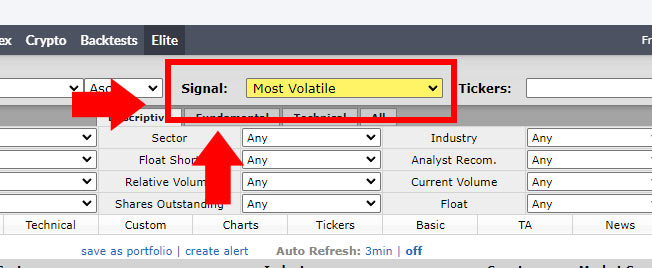

Firstly, you will need to go to the Finviz website and click on the Screener tab at the top.

Once the page loads, change the Signal option to “Most Volatile”.

The Signal option is at the top of the page, beside Tickers.

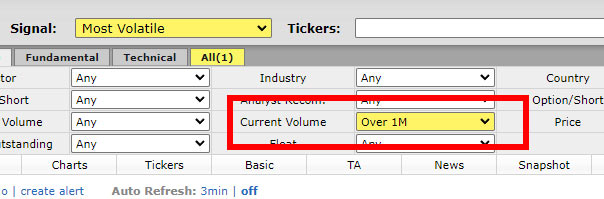

Now, let’s limit our results to stocks that have a high volume.

In the Descriptive tab, you will see an option called Current Volume.

This option is above the “Float” dropdown in the second last column.

In the screenshot above, you can see that we have set the Current Volume option to “Over 1 Million”. This basically weeds out most of the “questionable” low volume tickers that we want to avoid.

You can adjust this to a lower number if you want. However, you should try to stay above 100K.

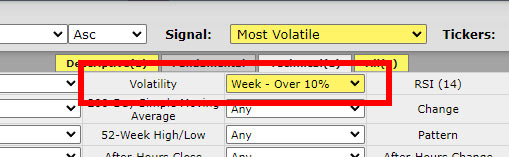

To narrow our list down even further, we can tell Finviz to only display stocks that have witnessed large price swings in the past week.

In order to do this, we will need to go into the Technical tab.

On the Technical tab, we will change the Volatility option to “Week – Over 10%”.

You can set this option to “Week – Over 15%” if you want to narrow down your list even further.

Once you have applied all of the options above, you can whittle down your list even further by applying other filters.

For example, you can screen out foreign equities by changing the Country option to USA. Or you can modify the various SMA filters to show stocks that are in an uptrend.

Volatility brings risk.

Please note that volatile stocks can be extremely risky. If the price of a stock can increase by 15% in one day, then it can also fall by 15% in one day.

Or even more.

A stock screener cannot predict the future. Therefore, you should never make the mistake of thinking that these filters will guarantee you success.

A screener is a helpful guide, nothing more. As always, do your own research before purchasing a stock.